The Financial Dilemma: Raising Children vs. Buying a Home

In the UK, a growing number of families are opting for fewer children, influenced by the increasing cost of living and unstable job markets that deter many young individuals from pursuing parenthood.

Current statistics reveal that the birth rate has plummeted to 1.44 children per mother, with the average age of childbirth reaching a record high of 30.9 years. A recent survey conducted by The Times highlights that many from Generation Z — those born from 1997 to 2012 — cite rising living expenses, exorbitant rent, and skyrocketing house prices as major deterrents to parenthood.

According to Melinda Mills, a demography and population health professor at the University of Oxford, “You have to consider mortgage commitments, the feasibility of purchasing a home, and launching your career. Additionally, job security is crucial, as is knowing when your next paycheck will arrive and how many hours you’ll work.”

Thus, the stark reality that the costs of raising two children can exceed £500,000 is unlikely to sway many couples from their plans.

To quantify these costs, real estate agency Savills conducted an analysis comparing a middle-class family’s expenses when raising two children and moving into suitable homes for 18 years, against the expenditure of remaining childless. Their findings indicate that opting for two children can incur an astronomical additional cost of £509,314.

If couples decide against having children, they could potentially allocate that considerable sum towards purchasing an average-sized detached house outright, with £60,000 left for additional expenses.

The housing crisis weighs heavily on the minds of prospective families. For individuals under 45, there has been a cumulative £3.5 billion rent increase over two years, largely due to landlords transferring high mortgage costs to tenants, according to data from Hamptons. Presently, the average home price for first-time buyers is five times their household income, and in premium locations, it can soar to 16 times their income.

In comparison, 25 years ago, this ratio stood at 3.6 times, and just 2.2 times in 1994. Currently, mortgage payments account for around 36% of a first-time buyer’s net income, significantly above the long-term average of 30%.

Many families find themselves grappling with the choice between having a baby and purchasing a home.

The Financial Implications of Parenthood

Savills’ calculation of £509,314 is based on data from the Child Poverty Action Group, which estimates how much it costs to provide a “socially acceptable living standard” for a couple with two children. This figure includes essentials like food and clothing, but does not factor in childcare or housing costs.

Additional costs were determined by including the average annual expense of a registered childminder for children under two (£6,547 per child, based on 25 hours a week).

To ascertain the potential expenses of upgrading living arrangements for growing families, Savills assumed that parents would have to make multiple house moves necessitated by their children’s needs. Initially, they would purchase a two-bedroom home, accommodate their first child, move to a three-bedroom home with the second child, and then upsize again to a four-bedroom residence. Conversely, childless couples would remain in their initial two-bedroom property.

The study presupposed that each property purchase would involve acquiring a mortgage at an average rate of 4.83%, with a 25% deposit and an arrangement fee of £999. The analysis was conducted using current average property values.

Researcher Nick Maud stated that individuals who remain childless and stay in the same two-bedroom property for 18 years would face an overall cost of £339,182, while parents would incur an additional £172,239 during the two-year span of having one child, plus another £337,075 after the birth of a second child, encompassing house moves and child-rearing expenses.

Ultimately, those opting for homeownership over raising a child stand to save a staggering £509,314, according to the analysis.

It’s important to note that these figures may not encompass the full spectrum of expenses since parental costs post-age two can vary significantly based on individual circumstances.

Lucian Cook, Savills’ director of residential research, reflects on a discussion he had with his 25-year-old daughter, whose peers are beginning to start families. “She is deeply concerned about the expenses involved,” Cook states.

With escalating housing and mortgage costs, families are often forced to make compromises, settling for homes that don’t reflect their preferences or driving vehicles they don’t admire, as Cook points out.

Rodica Topala-Gabura, 37, and Sergiu Gabura, 36, exemplify this compromise. In 2018, they were leasing a two-bedroom flat in southeast London at £2,000 per month when they welcomed children and required a larger space.

Unfortunately, they couldn’t afford a larger rental unit in Woolwich or purchase a property, even with a combined income of £150,000 (Rodica works as a contracts executive, while Sergiu is a software engineer). Property values in the Greenwich and Woolwich area have surged by 358% since 2000, according to Savills data, an increase of 148% when adjusted for inflation, with the average property costing £554,080.

The couple eventually relocated to Stonehaven Park, a newly developed area in Ebbsfleet, Kent, where they purchased a three-story townhouse for £490,000 to raise their two children, Traian, aged 6, and Mihai-Christopher, who is 11 months old. The price of their former two-bedroom flat in Royal Arsenal has now climbed to nearly £900,000, almost double its previous value.

Rodica admits her priorities shifted upon becoming a mother: “Our decision was not just based on affordability, but also on the quality of life we desired. I wanted a safer community with better schools and green spaces. Living in London posed challenges for family life due to space limitations.”

Choosing the Right Location

When it comes to finding a home, educational prospects are a major concern for families. Demand for properties near high-performing schools is expected to rise this year, especially as VAT has been introduced on private school fees, escalating costs for independent institutions.

However, schools are not the only consideration. Estate agency Jackson-Stops analyzed data from the Office for National Statistics alongside Sats test results for Year 6 pupils to identify top family-friendly locations. The wellbeing statistics from 2022-2023 detail local levels of satisfaction, worth, happiness, and anxiety.

According to their findings, Surrey Heath, home to picturesque villages like Bisley and Chobham, was ranked as the best area in England for family living. It boasts one of the highest wellbeing scores in the UK (7.9 out of 10) while exceeding national averages for educational achievement, with 65% of pupils meeting Sats targets. Woking, Rutland, Mole Valley, and North East Lincolnshire rounded out the top five.

Quality of life was paramount for Rebecca Reynolds and her husband, who faced multiple relocations after having a baby while living in a cramped flat in Eltham, southeast London. Initially unable to sell their property during the Covid-era demand for space, they opted to let it out and rented a new house where they subsequently welcomed another child. Her experience reflects the financial burdens families face regarding housing.

Upon finally selling their flat, they concluded that affording a four-bedroom house they desired in London was unattainable, leading them to the challenging decision of relocating to the village of Lingfield in southeast Surrey.

“With two children, we simply sought more space. A four-bedroom house in Eltham was out of our reach at around £850,000,” notes Reynolds, who works in public relations. Savills data indicates that Eltham property prices have surged by 397% over the past 25 years, or 169% when adjusted for inflation.

Rebecca and her husband strategically chose Lingfield on a map, seeking a more affordable and accessible option. “We realized, for £650,000, we could afford a beautiful four-bedroom detached home with a spacious garden, generous bedrooms, and two bathrooms. I commute easily by train.”

“Leaving behind my supportive community in Eltham was tough, but financial constraints guided our decision,” she added.

Could Rising House Prices Offset Child-Rearing Costs?

Families who decide to upsize may find an opportunity to alleviate child-related expenses through rising property values.

Research from Benham and Reeves shows that in 24 UK locations, house prices have increased over the past five years by amounts greater than the £75,000 expense associated with raising one child — in some areas, this has exceeded £120,645. Savvy property investments followed by timely downsizing could help offset the financial burden of raising children.

In regions like the Cotswolds, average home prices have risen to £503,865, jumping by £120,645 over the past five years. Meanwhile, in the London borough of Brent, property values have increased by £109,690, and they’ve gone up by £97,269 in Bath and North East Somerset.

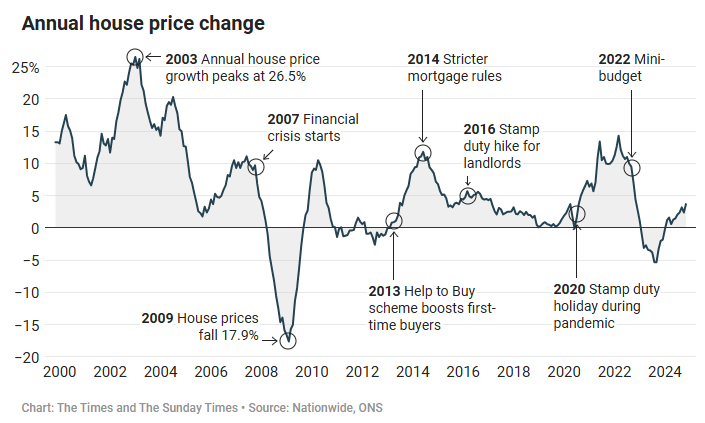

While these projections are appealing, it’s crucial to recognize that the property market can be volatile, with previous trends disrupted by events like the 2008 financial crisis, tax increases for second homes, and soaring mortgage rates since 2022.

Investing in property no longer guarantees substantial returns, and for families with children facing high mortgage payments post-2022, the financial reality may resemble a costly burden. Ultimately, the choice between starting a family and purchasing the home and vehicle of your dreams has never been more challenging.

Have you faced similar trade-offs in your life regarding children or housing? We’d love to hear your story in the comments below.

Post Comment