ekaterina-khuraskina.ru Recently Added

Recently Added

Jobs For 16 Year Olds That Pay A Lot

16 year old jobs in california · Cashier · Teacher / Teaching Positions (Preschool, Infant, Toddler) · Instructor II · Graduate Gemologist With Fine Jewelry Sales. Lots of those young people will do more than homework. They'll get a job. And if you're under 16 years old and you get a job, you also need to get a work permit. Information for youth ages for working papers, safety and health on the job, and filling out job applications. It takes a lot of Partners working behind That's a big deal to me because the bathrooms are one of the things the customers really pay attention to. We have hundreds of Twin Cities job opportunities to choose from across a variety of areas including retail, food, guest services, security, operations +. 16 years old jobs in Calgary, AB · 3rd & 4th Year Electrical Apprentices · Lead Electrical Designer (1 Year Contract) · Assistant Manager, Merchandising - Market. Browse MANHATTAN, NY 16 YEAR OLD jobs from companies (hiring now) with openings. Find job opportunities near you and apply! Big Lots is committed to the principle of equal employment opportunities for all employees, as well as providing them with a work environment free of. Positions such as cashier, food service worker, or stock clerk often offer weekly pay. Additionally, opportunities like babysitting or dog. 16 year old jobs in california · Cashier · Teacher / Teaching Positions (Preschool, Infant, Toddler) · Instructor II · Graduate Gemologist With Fine Jewelry Sales. Lots of those young people will do more than homework. They'll get a job. And if you're under 16 years old and you get a job, you also need to get a work permit. Information for youth ages for working papers, safety and health on the job, and filling out job applications. It takes a lot of Partners working behind That's a big deal to me because the bathrooms are one of the things the customers really pay attention to. We have hundreds of Twin Cities job opportunities to choose from across a variety of areas including retail, food, guest services, security, operations +. 16 years old jobs in Calgary, AB · 3rd & 4th Year Electrical Apprentices · Lead Electrical Designer (1 Year Contract) · Assistant Manager, Merchandising - Market. Browse MANHATTAN, NY 16 YEAR OLD jobs from companies (hiring now) with openings. Find job opportunities near you and apply! Big Lots is committed to the principle of equal employment opportunities for all employees, as well as providing them with a work environment free of. Positions such as cashier, food service worker, or stock clerk often offer weekly pay. Additionally, opportunities like babysitting or dog.

Jobs for year-olds have a lot of rules, we tell you everything you need to know. All the laws and how much you can get paid! Sign up to find jobs for. What age you can get a job · Working hours · 14 year olds · 15 and 16 year olds · 16 and 17 year olds · The National Minimum Wage · Time off and holidays · If you get. Pay starts at $16 per hour in foods & rides; First 2 All applicants must be at least 16 years of age or older at the time the application is completed. also not discriminate in hiring, pay, or other benefits based on your: and year-olds. School Nights. 6 a.m. – 10 p.m.. (or until p.m. if. A lot of places are doing their summer hiring. You can always try McDonalds or Taco Bell too. Grocery stores usually hire high schoolers too! With over campuses across the United States, Job Corps provides free career training and education for low-income through year-olds. AMC hires crew members 14 and older at select locations. Job tasks may include: selling tickets, working concessions, and ushering auditoriums. Average pay: $ Because some employers are willing to hire teenagers for the role, it's another one of the highest-paying jobs for year-olds. In fact, a lot of healthcare. lot of fun planning a themed bash. This year, while homing in on a birthday [ ] Beth Grobstein and her son, 8-year-old Crew, know the importance. Wear a. Top 20 Jobs for Year-Olds · 1. Babysitter · 2. Golf Caddy · 3. Farmhand · 4. Restaurant Server · 5. Newspaper Delivery · 6. Dog Walker · 7. Gardener · 8. Tutor. What you'd do: This is one of those jobs for teens that may feel like you're doing your chores—except you're getting paid. Where there are diners, there. You will need working papers if you are under 18 years old. Working papers are divided into two age groups ( and ). If you are 16 or over, becoming a customer service representative is one of the best ways to make a regular income. Average pay starts around $10 an hour, or. There are a lot of jobs you can get at 13! However, you must remember that in the eyes of the law, you're still a child, and unfortunately, that means you are. Restaurant team member: There are many things teens can do in restaurants, from hosting to serving, doing dishes, and cooking. The average pay is $, but it. Are you looking for a job that's a lot more than just “a job”? Ready to At least 16 years of age. • Strong communication and interpersonal skills. p.m. and a.m. must be paid at least the adult minimum wage for those hours. [LC. ] As the chart indicates, 16 and 17 year olds enrolled in a school. If you are 16 or over, becoming a customer service representative is one of the best ways to make a regular income. Average pay starts around $10 an hour, or. Or what if you could fast-track your education and complete a degree program in less than four years? It would likely make you feel a lot better about your.

Best Broker For Indices

Trade indices online with Exclusive Markets a global award winning and regulated broker. Take benefits of global index trading with competitive spreads. How to choose the best forex broker · What is margin trading? How to find the It's important to choose an index that's best-suited to your trading style. Top Indices Trading Brokers · 1. Fusion Markets. Min Deposit. $0. Fees · 2. eToro. Min Deposit. $10 - $ Fees · 3. XM Group. Min Deposit. $5. Fees · 4. At iFX, You Can Trade a Wide Range of indices. Here are some of the most heavily traded live indices markets available: · The Spain 35, or IBEX 35, is a. Choose a broker that you can trust, the one who supports you with everything that you need to excel as a trader. Millions of traders choose to trade CFD indices. ekaterina-khuraskina.ru is a well-established forex broker that offers access to the MetaTrader 4 platform as well as its own proprietary platform, TradeStation. It offers a. Top 10 Best Brokers for Indices Trading · 2. Hotforex (HFM) · 3. eToro · 4. XTB · 5. Pepperstone · 6. AvaTrade · 7. Fusion Markets · 8. Oanda · 9. IC Markets. Some of the most popular brokers offering synthetic indices trading include eToro, TD Ameritrade, IG, et cetera. It is important to compare the. When you trade indices with us, you can profit from both rising and falling markets. You only have to put up a fraction of the index price to start trading. Trade indices online with Exclusive Markets a global award winning and regulated broker. Take benefits of global index trading with competitive spreads. How to choose the best forex broker · What is margin trading? How to find the It's important to choose an index that's best-suited to your trading style. Top Indices Trading Brokers · 1. Fusion Markets. Min Deposit. $0. Fees · 2. eToro. Min Deposit. $10 - $ Fees · 3. XM Group. Min Deposit. $5. Fees · 4. At iFX, You Can Trade a Wide Range of indices. Here are some of the most heavily traded live indices markets available: · The Spain 35, or IBEX 35, is a. Choose a broker that you can trust, the one who supports you with everything that you need to excel as a trader. Millions of traders choose to trade CFD indices. ekaterina-khuraskina.ru is a well-established forex broker that offers access to the MetaTrader 4 platform as well as its own proprietary platform, TradeStation. It offers a. Top 10 Best Brokers for Indices Trading · 2. Hotforex (HFM) · 3. eToro · 4. XTB · 5. Pepperstone · 6. AvaTrade · 7. Fusion Markets · 8. Oanda · 9. IC Markets. Some of the most popular brokers offering synthetic indices trading include eToro, TD Ameritrade, IG, et cetera. It is important to compare the. When you trade indices with us, you can profit from both rising and falling markets. You only have to put up a fraction of the index price to start trading.

Best Synthetic Indices Brokers · Pepperstone · FP Markets · XTB · AvaTrade · IC Markets. Best brokers for indices · Interactive Brokers | Best overall broker for indices · eToro | Best for social trading · Webull | Best for low fees · Interactive. Stock indices are popular trading vehicles, and they become even better with a high leverage forex broker that can offer them as CFDs. Investors, veteran traders and market analysts, all consider Index CFDs to be a good vehicle to manage the risks associated with stock trading. The sheer. Saxo Markets is the best broker for sophisticated and high-net-worth index traders as their platform is geared towards professional traders placing large orders. Indices, representing groups of stocks from specific markets or sectors, offer a comprehensive view of market performance. Engaging in index trading allows you. Brokers For Cboe Index Options and Futures Products. In order to assist market participants that would like to engage in transactions in the Cboe index. Comparing brokers before trading indices is a crucial step that can significantly impact your trading success. With the multitude of brokers available, each. ekaterina-khuraskina.ru is a well-established forex broker that offers access to the MetaTrader 4 platform as well as its own proprietary platform, TradeStation. It offers a. AvaTrade has been recognised with multiple industry awards for its outstanding services, affirming its status as one of the best brokers for index trading. Traits for The Best Indices Broker TMGM stands out as an indices broker. In addition to offering 15+ indices, we have accounts for the MetaTrader 4 and IRESS. If you're looking to start investing in index funds, you'll need to pick the best brokers for index funds. Learn more now. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. AvaTrade has been recognised with multiple industry awards for its outstanding services, affirming its status as one of the best brokers for index trading. OANDA TMS Brokers S.A. takes all necessary actions so that its subcontractors and other cooperating entities guarantee the use of appropriate security measures. Which Indices are Best to Trade? · Dow Jones Industrials Average (US 30) · Standard & Poor's (S&P ) · Nasdaq (Composite and Nasdaq ) · UK FTSE (FTSE. I'd say full service brokers like ICICI direct or Motilal oswal are the best brokers. They give good recommendations which are useful for. Analyse the index markets and determine which indices you wish to trade Best CFD Broker. Global Brands Magazine. Indices Trading. Best. Quick Indices Brokers Comparison Table ; ekaterina-khuraskina.ru 15+. pips. FCA, CFTC, NFA, CySEC, ASIC, CIRO ; eToro. 21+. pips. FINRA, SEC, FCA, ASIC, CySEC. Read our Best Indices Trading Broker Review with trading conditions, user's reviews and rating. Choose your broker from our regulated crude oil broker list.

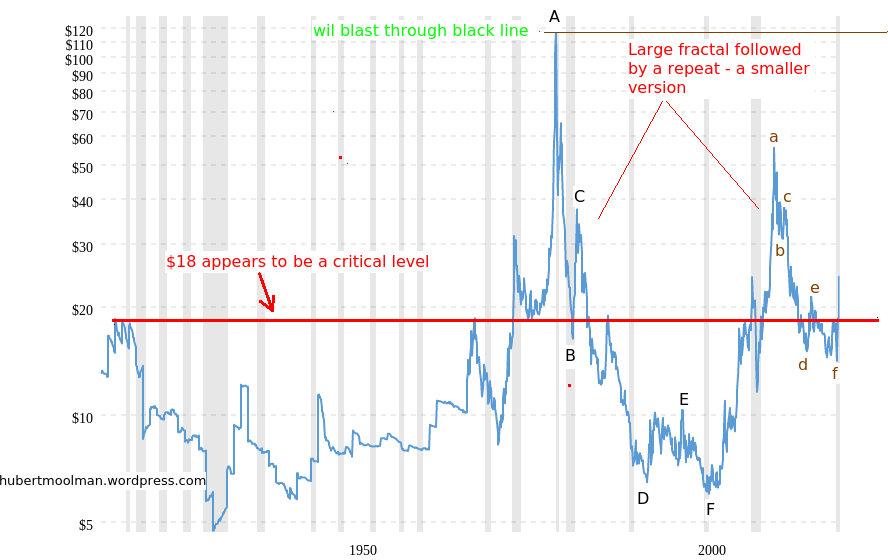

Inflation And Silver Prices

We firmly believe that our silver price forecasts of 20will materialize in Our longstanding targets are and 50 USD. Keep in mind that the strong performance of gold and silver has been in spite of a tighter Federal Reserve monetary policy, which should in theory have caused. The current price of silver as of September 10, is $ per ounce. Historical Chart; 10 Year Daily Chart; By Year; By President; By Fed. Silver spot price needs to break above the $ resistance on the daily timeframe to gain a strong bullish outlook on a higher timeframe. The current price of Silver is $1, per kilogram. Please note that the price provided above is the retail price for private investors and is aligned. Inflation is another factor that affects gold and silver prices, which is one of the primary reasons individuals invest in gold and silver. To boil it down into. 1 year ago today silver was selling at $ Today it's selling at ~ So not including any over priced premiums, while inflation rose Importantly, correlations between gold and silver prices have also broken down. From through , the correlation sank to 22% as gold prices were under. Silver is an inflation-protected store of value. The opportunity cost of holding silver futures is the real interest rate, which is nominal interest rate. We firmly believe that our silver price forecasts of 20will materialize in Our longstanding targets are and 50 USD. Keep in mind that the strong performance of gold and silver has been in spite of a tighter Federal Reserve monetary policy, which should in theory have caused. The current price of silver as of September 10, is $ per ounce. Historical Chart; 10 Year Daily Chart; By Year; By President; By Fed. Silver spot price needs to break above the $ resistance on the daily timeframe to gain a strong bullish outlook on a higher timeframe. The current price of Silver is $1, per kilogram. Please note that the price provided above is the retail price for private investors and is aligned. Inflation is another factor that affects gold and silver prices, which is one of the primary reasons individuals invest in gold and silver. To boil it down into. 1 year ago today silver was selling at $ Today it's selling at ~ So not including any over priced premiums, while inflation rose Importantly, correlations between gold and silver prices have also broken down. From through , the correlation sank to 22% as gold prices were under. Silver is an inflation-protected store of value. The opportunity cost of holding silver futures is the real interest rate, which is nominal interest rate.

The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price. This means shortages in supply (as demand increases, for the reasons we outlined in our essay last week) will lead to higher prices for silver. Then there's the. Prices tend to rise when the supplies are low. When the dollar weakens, investors begin to look to more stable investments like precious metals, such as silver. Silver Forecast: Rallies, Faces $30 Test {Video} · Silver/USD rises to near $ due to dovish Fedspeak · Silver/USD rallies to near $29 as Fed deeper rate cut. The price of silver today, as of am ET, was $28 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. The current price of silver is $ per troy ounce. Silver's price is up % from the previous trading day. Historical data below. Due to its long history of use as a medium of exchange, silver markets continue to be influenced by government actions and policies. For example, while gold. Silver began at $24 and has since risen over 5%. Though the precious metal suffered a dip in March, falling to $20 it has gone up by 18% in the past month. From to , silver price was raised by the US, more than doubling within the three years, forcing silver to flow out of China. Silver increased USD/t. oz or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Gold has consistently demonstrated a strong correlation with inflation. When inflation rises, the price of gold also tends to increase. From to , silver price was raised by the US, more than doubling within the three years, forcing silver to flow out of China. Silver is a commodity that trades virtually 24 hours per day across many exchanges such as New York, Chicago, London, Zurich and Hong Kong. This is a change of % from last month and % from one year ago. Report, IMF Primary Commodity Prices. Categories, Agriculture and Livestock, Chemicals. Thus, when interest rates are low, the demand for gold and silver typically increases, pushing their prices upward. Historical trends have demonstrated this. Since inflation means the decrease in the value of fiat (paper, unbacked by metals) money, people turn to assets that proved to be money throughout history -. As a result, gold is much more stable. While the dollar's value may rise and fall, the value of gold will remain steady. The same can be said for silver. That. Generally it is thought that this high inflation was caused by the large influx of gold and silver from the Spanish treasure fleet from the New World; including. The price of this precious metal is influenced by a complex set of factors that can change rapidly and unpredictably.

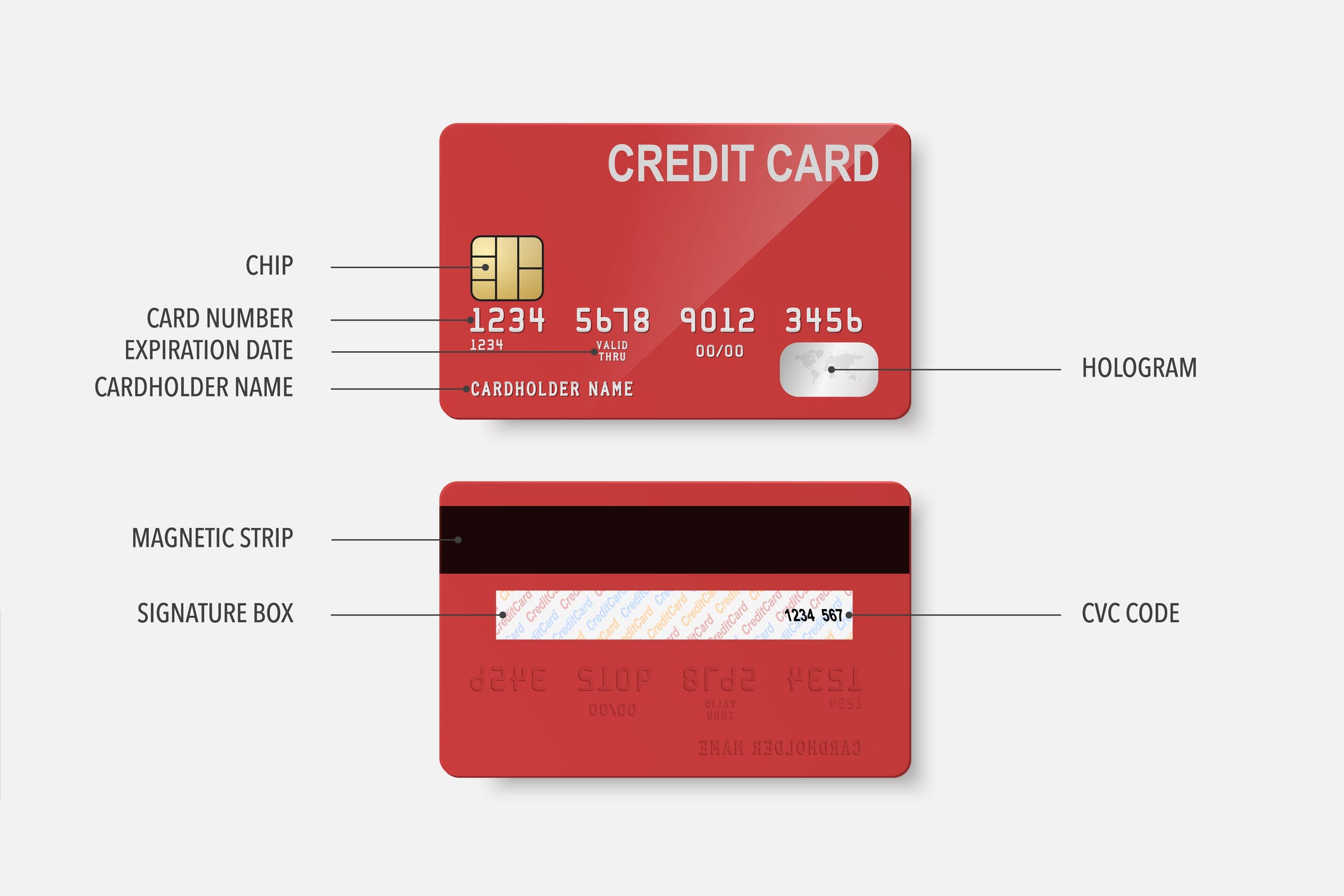

How Much Should I Use On A 300 Credit Card

Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card offers. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. Experts generally recommend keeping your utilization rate below 30% (depending on the scoring system used) — but CNBC Select spoke to two credit gurus who say. Often you'll hear terms like “APR,” “balance transfer,” “interest,” and “credit score,” but what does it mean? Here we've broken down the common credit card. When you apply for a credit card, one piece of information you'll be asked to supply is your annual income. Whether you get paid annually, hourly, by. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization ratios. Experts suggest keeping your spending to 30% or less of your total credit limit. Photo illustration by Fortune; Original photo by Getty Images. What's even. It's usually recommended that cardholders keep their card utilization rate below 30% to avoid negative effects on their credit score. In the above example, that. Experts generally recommend maintaining a credit utilization rate below 30%, with some suggesting that you should aim for a single-digit utilization rate . Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card offers. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. Experts generally recommend keeping your utilization rate below 30% (depending on the scoring system used) — but CNBC Select spoke to two credit gurus who say. Often you'll hear terms like “APR,” “balance transfer,” “interest,” and “credit score,” but what does it mean? Here we've broken down the common credit card. When you apply for a credit card, one piece of information you'll be asked to supply is your annual income. Whether you get paid annually, hourly, by. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization ratios. Experts suggest keeping your spending to 30% or less of your total credit limit. Photo illustration by Fortune; Original photo by Getty Images. What's even. It's usually recommended that cardholders keep their card utilization rate below 30% to avoid negative effects on their credit score. In the above example, that. Experts generally recommend maintaining a credit utilization rate below 30%, with some suggesting that you should aim for a single-digit utilization rate .

A good rule of thumb is to never use more than 30% of your credit limit, because if you go over that mark, your credit score will suffer. Paying on time, every. Carrying more debt may suggest that you have trouble repaying what you borrow and could negatively impact your credit scores. How to calculate your credit. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card offers. Must qualify for a minimum credit line of $5, No caps on how much you can earn. No cash back expiration dates to worry. Before opening a new card, give yourself clear guidelines on how you'll use the card and stick to keeping a low credit utilization rate. When it comes time to. From there, you can work on whittling that down to 10% or less, which is considered ideal for raising your credit score. Use your credit card's high balance. For example, if you owe $2, to your credit card and loans combined but only have a $4, credit limit on your card, you're using more than 50% of available. For example, if you have a $1, credit limit, you should try to keep your balance below $ Using 30% or less of your credit limit is favorable to the. 2) Optimize Your Credit Utilization Ratio If you already have one or more credit cards, this could be the biggest move to make if you want to get to +. Security deposit – The deposit amount required varies by issuer, but it is usually in the range of $ to $ Remember, your credit limit is generally equal. should—use helps to build better credit scores and keep you from maxing out. Read, 3 minutes. If you have ever used a credit card how much of your total. Most experts recommend keeping utilization below 30%, on a card-by-card basis and overall, to avoid hurting your credit score. Utilization rate contributes as. You have a long history with the account. You can often request a credit limit increase online, over the phone or through a lender invitation. To submit a. How much will this action impact your credit score? · Carrying $ on a card with a $1, limit is 70% utilization. If you're approved for a new card with a. A $ credit card limit with no deposit offers an accessible way to build or rebuild credit without the upfront cost of a security deposit. Use this calculator to determine how long it will take you to payoff your credit cards if you only make the minimum payments. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card offers. How does a credit card work? A credit card allows you to borrow money, with Credit scores range from to – the higher, the better. Learn. When you apply for a credit card, your FICO score is typically a key factor used to show lenders how reliably you manage your credit. It. Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%, 3%, 4%, 5%.