ekaterina-khuraskina.ru Tools

Tools

Best Internet Service For Business

Our ratings of best internet providers help you find the best ISPs in your area. We also rate and review the fastest and the cheapest internet plans. Cox offers cable and fiber internet plans with a good range of download speeds and pricing. It also places in our Best Fiber ISPs, Best Cable ISPs, and Best. Overall, Verizon has been the highest ranked for customer satisfaction for small and medium businesses for six years straight by J.D. Power. The company offers. The best internet provider is Google Fiber, which delivers superb performance over gigabit and multi-gigabit speeds all at a fair price, with unlimited data. Switch to Business Internet with speeds of up to 2 Gig 8 and a next-gen WiFi 6 capable modem for faster business via secure WiFi networks. The bottom line: The best high-speed internet provider for small businesses is Verizon. Verizon does a great job ensuring affordable prices, fast speeds, and. This guide dives into many internet service providers, dissecting their offerings to help you make an informed decision. Our picks for the best business internet providers · Best for reliability: AT&T Mbps · AT&T business internet plans and pricing · Best cheap business internet. Get high-speed business internet from Spectrum starting at $/mo. Reliable, fast, and no contracts. Enjoy Spectrum's cost-effective business internet. Our ratings of best internet providers help you find the best ISPs in your area. We also rate and review the fastest and the cheapest internet plans. Cox offers cable and fiber internet plans with a good range of download speeds and pricing. It also places in our Best Fiber ISPs, Best Cable ISPs, and Best. Overall, Verizon has been the highest ranked for customer satisfaction for small and medium businesses for six years straight by J.D. Power. The company offers. The best internet provider is Google Fiber, which delivers superb performance over gigabit and multi-gigabit speeds all at a fair price, with unlimited data. Switch to Business Internet with speeds of up to 2 Gig 8 and a next-gen WiFi 6 capable modem for faster business via secure WiFi networks. The bottom line: The best high-speed internet provider for small businesses is Verizon. Verizon does a great job ensuring affordable prices, fast speeds, and. This guide dives into many internet service providers, dissecting their offerings to help you make an informed decision. Our picks for the best business internet providers · Best for reliability: AT&T Mbps · AT&T business internet plans and pricing · Best cheap business internet. Get high-speed business internet from Spectrum starting at $/mo. Reliable, fast, and no contracts. Enjoy Spectrum's cost-effective business internet.

WiLine DIA offers a dedicated, high-capacity fixed wireless internet connection that ensures your business enjoys consistent high-speed internet access without. What's the latency like on Starlink compared to a standard sat connection? Ses is a great company but the connection is a bit pants for. For example, major ISP TekSavvy has a coverage percentage of 84%—yet dominant companies like Bell Canada, Telus, and Rogers all have less coverage. All of those. There are hundreds of internet providers in Canada. Some of them are major companies that service large portions of the country, such as Bell and Rogers, while. The Best Internet Service Providers of · AT&T Business:Best for Symmetrical Speeds · Comcast Business ISP:Best for Enterprise Businesses · Spectrum. Best internet service providers for small businesses · Verizon · AT&T Internet for Business · Comcast Business Internet · Cox · Viasat Business · Spectrum Business. Charter enterprise has been better. Going from 25/25 to 1gig was a 30 min phone and a couple of papers signed. What are your business' internet speed needs? ; Verizon. Best overall. out of 5 stars ; Frontier Business. Best budget option. 4 out of 5 stars ; AT&T Business. Phoenix Internet is a large and small business internet provider offering reliable high-speed business Internet access in areas that others can't. Best overall. Verizon Home Internet. Verizon Business. Price: $–$/mo. · Best for customer satisfaction. AT&T Business. Price: $–$/mo. · Best. Verizon Business #1 by J.D. Power 6 years in a row. #1 in Customer Satisfaction for Small Business Internet Service. For the 6th year in a row, small. Here are a few providers that rank the highest with their steady and fast internet connection and quality service. Save on 5G Business Internet for small businesses from America's fastest growing internet provider when paired with any voice line. Sign up online or by. For fast, reliable internet, advanced business solutions, great deals, plus: Restrictions apply. Not available in all areas. Comcast Business WiFi Pro. Enter your zip so we can find the best providers in your area: ; AT&T. Save 50% off our best internet plan! Whether you're a small office or growing enterprise, Ooma Connect is the perfect wireless internet service for your. Best cable internet providers ; ATT. AT&T Small Business. 25– Mbps. $ ; Verizon Fios Business. 3–15 Mbps. $ ; CenturyLink Business. Mbps. We'll show a list of business internet providers in your area, the services they offer, and a free consultation with one of our experts that can help connect. Business Internet Service. Fast, reliable and built for the way Get the fastest connection available with best-in-class security and premier support.

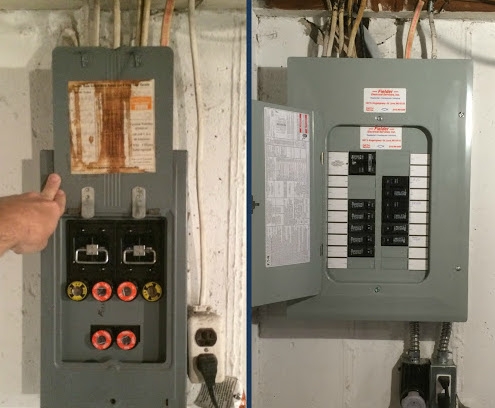

How Much To Install Electrical Panel

install an electrical sub-panel, along with per unit costs and material requirements. See professionally prepared estimates for electrical sub-panel. Generally speaking, electrical panels need to be replaced every 25 to 40 years. Therefore, if you're living in an older home, there's a higher likelihood that. The basic cost to Install an Electrical Service Panel is $ - $ per panel in April , but can vary significantly with site conditions and options. Like we mentioned earlier, installing a volt outlet for your dryer requires running wire from your main electrical panel to the dryer's location. “. A SPAN Panel costs $3, before installation, compared to the $ cost of a traditional electrical panel. Buying a SPAN Panel qualifies a homeowner for a tax. Cost to Install or Replace an Electrical Panel in Phoenix. Low cost $4, Average cost $7, High cost $10, Pricing Curve. Factors that. Electrical panel replacement costs $ to $, depending on the location, the type of hardware, and any required building materials. According to data collected by the home repair website ekaterina-khuraskina.ru, the average subpanel installation cost, nationwide, is $1, This average point is taken from. Depending on the size of the panel, the age of your home and when the service is completed, the cost of the project will range between $$2, Additional. install an electrical sub-panel, along with per unit costs and material requirements. See professionally prepared estimates for electrical sub-panel. Generally speaking, electrical panels need to be replaced every 25 to 40 years. Therefore, if you're living in an older home, there's a higher likelihood that. The basic cost to Install an Electrical Service Panel is $ - $ per panel in April , but can vary significantly with site conditions and options. Like we mentioned earlier, installing a volt outlet for your dryer requires running wire from your main electrical panel to the dryer's location. “. A SPAN Panel costs $3, before installation, compared to the $ cost of a traditional electrical panel. Buying a SPAN Panel qualifies a homeowner for a tax. Cost to Install or Replace an Electrical Panel in Phoenix. Low cost $4, Average cost $7, High cost $10, Pricing Curve. Factors that. Electrical panel replacement costs $ to $, depending on the location, the type of hardware, and any required building materials. According to data collected by the home repair website ekaterina-khuraskina.ru, the average subpanel installation cost, nationwide, is $1, This average point is taken from. Depending on the size of the panel, the age of your home and when the service is completed, the cost of the project will range between $$2, Additional.

The average cost to replace or upgrade an electrical panel is about $ (upgrade an existing amp panel to a amp panel with no change in position. It could cost as little as $ to upgrade an existing panel, while replacing an entire fuse box or panel could cost $1, or more. How long will it take to. Circuit Breaker Installation & Replacement Costs Near Orlando, FL. New Circuit Breaker & Panel Install Assessment + Techs Available Now. How much will that cost? Can you replace the panel yourself? We have the answer to these questions and more, read on! Homeowner's Intro to the Electrical Panel. Replacing a circuit breaker panel can cost anywhere from $1, to $3,, depending on the complexity of the job and your location. It depends. We will come to your home · Analyze your new circuit breaker & panel installation needs · Present you with personalized solutions on what to do next · %. Installing a main electrical panel typically costs $3,, according to Yelp data, but ranges from $1,–4,, including labor and materials. Installing a. When it's time to install a new circuit breaker, your first question may be how much it'll cost. Unfortunately, there's no one-size-fits-all answer. The cost of. It costs about $ to install solar panels. That's a big number, but it can come down significantly with generous incentives from the federal government. Installing a main electrical panel typically costs $3,, according to Yelp data, but ranges from $1,–4,, including labor and materials. Installing a. According to data collected by the home repair website ekaterina-khuraskina.ru, the average subpanel installation cost, nationwide, is $1, This average point is taken from. The average cost of replacing an electrical panel ranges from $ to $10, This cost includes the cost of the panel, the installation, and any necessary. The average cost will be between $ and $. Let us walk you through the basic installation steps. The average cost of replacing an old electrical panel with a new one of the same capacity costs the average Canadian homeowner about $3,, although that range. install an electrical sub-panel, along with per unit costs and material requirements. See professionally prepared estimates for electrical sub-panel. Like we mentioned earlier, installing a volt outlet for your dryer requires running wire from your main electrical panel to the dryer's location. “. We will come to your home · Analyze your new circuit breaker & panel installation needs · Present you with personalized solutions on what to do next · %. A homeowner should expect to pay between $ and $2, to upgrade an existing unit to amp service, including professional installation. Alone, a amp. Cost: Upgrading an electrical panel is an added cost (typically $2,–$4,), involving the cost of the panel itself, labor charges, and any necessary.

What Do I Need To Open Up Bank Account

Whether you apply for a bank account online or in person, you'll need a government-issued ID and personal details, such as your Social Security number on hand. You will need to provide the following: Our bank routing number. This nine-digit number is found on the bottom left of your checks. Your checking account number. What do I need to open a checking account? · Identification. · Proof of address. It must show your name and address of your residence. · Opening deposit. You may. What do I need to open a checking account? To open a checking account, please have the following information prepared: Driver's License, Passport, Military. What You Need to Open a Checking Account · a social security number · a US residential address (not a PO box) · Funding account (routing & account number). What does it take to open a bank account online? · Go to the bank's website. Stay safe! · Choose the type of account you want. Most banks let you compare. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. What do I need to open a checking account? You can open a PNC checking account online or in person. You'll need: A U.S. government-issued photo ID such as a. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. Whether you apply for a bank account online or in person, you'll need a government-issued ID and personal details, such as your Social Security number on hand. You will need to provide the following: Our bank routing number. This nine-digit number is found on the bottom left of your checks. Your checking account number. What do I need to open a checking account? · Identification. · Proof of address. It must show your name and address of your residence. · Opening deposit. You may. What do I need to open a checking account? To open a checking account, please have the following information prepared: Driver's License, Passport, Military. What You Need to Open a Checking Account · a social security number · a US residential address (not a PO box) · Funding account (routing & account number). What does it take to open a bank account online? · Go to the bank's website. Stay safe! · Choose the type of account you want. Most banks let you compare. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. What do I need to open a checking account? You can open a PNC checking account online or in person. You'll need: A U.S. government-issued photo ID such as a. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find.

4. Bring Up-to-Date Documentation · Photo ID (such as driver's license or passport) and current identifying information of all signing parties · Bill showing your. Banks are required by law to have a customer identification program that includes performing due diligence (also called Know Your Customer) in creating new. Two forms of valid ID are required: Driver's License or State Issued ID or Passport. The second form of identification includes: Social Security Card, Birth. They do not open bank accounts without certain details about you. This is to protect them and to comply with a variety of regulations. You'll need to provide. Bank, credit card, or mortgage statement issued within the last 60 days; Prior year Federal or State Income Tax Return; Current lease agreement; Current vehicle. Generally, they will want a form of ID, your social security number (SSN), and a proof of your physical address. If you do not have an SSN, the bank will need. Government-issued ID with photo; Current utility bill with your name and address; Other (rental agreement, etc.) You will need two forms of identification – a. To open a checking account, you must provide government-issued identification with your photo, your Social Security card or Taxpayer Identification Number, and. Opening a checking account is fast and easy. Youʻll need the following to get started: Name, social security number, date of birth (all applicants); Phone. When opening your Gate City Bank checking or savings account, you'll simply need a form of ID, your Social Security number and an opening deposit. What you'll need to get started · Proof of Identification. You'll likely need some information from a government-issued ID, like a driver's license, state ID, or. It can vary a little from bank to bank but there are typically some fundamental necessities needed to open a checking account. Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today. What to Bring with You to Open an Account in a Branch · One valid form of primary identification, like a driver's license, valid passport, or government-issued. You'll need the following information: Your Social Security number; A valid, government-issued photo ID like a driver's license, passport or state or military. You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible. What do I need to open an account online? To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile. Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single direct deposit of at least $ per month. If you open it in person, you'll likely need two forms of ID (such as a driver's license, Social Security card, passport or birth certificate) and proof of. To apply you'll need your Social Security Number and a U.S. Government issued ID, like a driver's license or a passport. You also need a means to fund your new.

Our Time Fees

It's free to register on Ourtime Ready to start your dating adventure? Registration to Ourtime is free and simple. It will only take you a couple of minutes. our public API. Most popular. Personal ProFor professionals who want to bill their time. –. Start free trial. Everything in Personal, plus: Billable rates and. Premium Subscription ; 1 Month, GBP / Month, GBP ; 3 Months, GBP / Month, GBP ; 6 Months, GBP / Month, GBP. Seasonal Rates (Nightly) This luxury rental is located in a private community of 10 homes that share a gulf front pool and private beach of their own. It is. Each Boost costs $, unless you happen to catch a special where they are discounted to $ each. The sunk cost fallacy is our tendency to follow through on something that we've already invested heavily in (be it time, money, effort, emotional energy, etc.). All memberships paid by credit card automatically renew until canceled. This also protects you from future price increases and service fees on new purchases. OurTime also offers a six-month value subscription package at the low price of $ per month that gives you the full OurTime experience while locking certain. Subscriptions are billed as follows: 1 month for £, 3 months for £ and 6 months for £ and are automatically renewed for successive periods of. It's free to register on Ourtime Ready to start your dating adventure? Registration to Ourtime is free and simple. It will only take you a couple of minutes. our public API. Most popular. Personal ProFor professionals who want to bill their time. –. Start free trial. Everything in Personal, plus: Billable rates and. Premium Subscription ; 1 Month, GBP / Month, GBP ; 3 Months, GBP / Month, GBP ; 6 Months, GBP / Month, GBP. Seasonal Rates (Nightly) This luxury rental is located in a private community of 10 homes that share a gulf front pool and private beach of their own. It is. Each Boost costs $, unless you happen to catch a special where they are discounted to $ each. The sunk cost fallacy is our tendency to follow through on something that we've already invested heavily in (be it time, money, effort, emotional energy, etc.). All memberships paid by credit card automatically renew until canceled. This also protects you from future price increases and service fees on new purchases. OurTime also offers a six-month value subscription package at the low price of $ per month that gives you the full OurTime experience while locking certain. Subscriptions are billed as follows: 1 month for £, 3 months for £ and 6 months for £ and are automatically renewed for successive periods of.

From here, you can choose to Hide profile/deactivate account. Please note, all emails, photos, records relating to your profile, remaining time and account will. Ticket Prices. $, $, $ (plus ticketing fees). Availability. On Sale Now. Doors Open. P.M.. Age Guideline. Appropriate and Beautiful for Ages. fees for each year of full-time undergraduate study. To be eligible a student Our Time Has Come Scholarships. The Our Time Has Come Scholarships are. There is a small one-time fee added to the cost of your plan when you first sign up, then your subscription auto-renews. You can easily change or cancel your. Paying month-to-month costs $ per month, while committing to a 6-month plan brings the price down to $ per month. You will also have access to a. 12 Months, USD / Month, USD ; Standard Subscription ; 1 Week, USD / Week, USD ; 3 Months, USD / Month, USD. If you drive a plug-in electric vehicle, you can enroll in our Time of Use rate option. Under this option, the price you pay for electricity depends on when. Start online dating with Ourtime to meet like-minded singles over 50 near you. Sign up for free and discover also our activities around you. As a testament to our time in the community, we are throwing a big party! Join us on Saturday, September 7 from PM to PM on the 13th hole for live. Participants will receive an annual letter that compares total charges for their usage under the Time-of-Use and standard rates. What are the peak hours? The. But that's my personal opinion. After this is the second time they've tried to charge me for membership that I have not ever signed up for. fee!!! I would have happily signed up and committed for six months at the given price if I could have paid monthly. But no way could I afford the full six. SMUD's Time-of-Day Rates give you the flexibility to control your electric bill. Learn how to shift your electricity usage and save more on your bill. All other surcharges, including Power Supply Cost Recovery (PSCR), are not included in the stated base rate. You're in Control of Your Energy Usage. Our newest. Under our residential time-of-use rate, you'll pay less than our standard rate for electricity any time of day between October and May. Your generation charges may come from a Community Choice Aggregator (CCA) or SDG&E, both of which purchase or generate electricity on behalf of their customers. Our eharmony membership terms and prices are also available on the Finding and cultivating these connections requires time and effort, but it's all worth it. Our Time-of-Use Rate option is one way we're delivering on our promise to provide members with affordable rates and options that fit their individual energy. Our time to love life together. Ourtime is the dating site for singles Enjoy reduced rates on our Activities and Outings in your area or online and. Our time to love life together. Ourtime is the dating site for singles Enjoy reduced rates on our Activities and Outings in your area or online and.

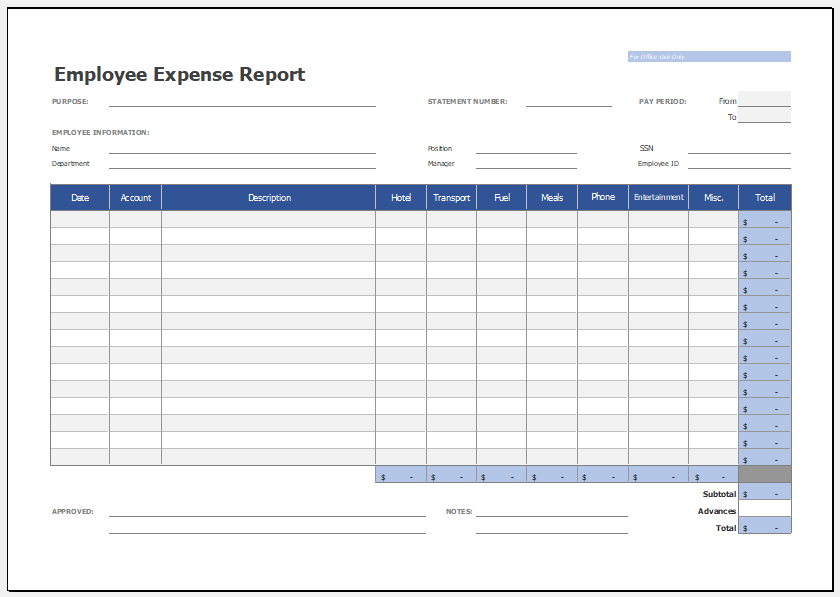

Employment Expenses Form

Attach a copy of this form to your paper return. Use this form only if you are an employee and your employer requires you to pay expenses to earn your. InstructionsUpdated: 4/PurposeTo provide a method for households to report self-employment income and expenses, if accurate tax or business records are. To enter unreimbursed employee expenses in your TaxAct return, go to our Form - Entering Unreimbursed Employee Expenses in Program FAQ. If you have a disability and claimed impairment-related work expenses on federal Form , complete Schedule M1UE and enter the amount from line 10 of this. Form is not needed and does not generate. If mileage is used on Form , it already includes a depreciation component. If actual expenses are more. Claiming tax deductible employment expenses; Allowable expenses; Flat rate deductions; Subscriptions; Course and examination fees; If your employer pays. Do you have unreimbursed expenses to include on your tax return? Learn how tax reform has changed the rules for unreimbursed employee expenses. The Canada Revenue Agency (CRA) has published revised guidance on the process for claiming home office expenses for the taxation year just in time for tax. Obtain T Declaration of conditions of employment · Complete the T and TWS · Related expenses to a T4 slip · Claim a GST/HST rebate · Select options for. Attach a copy of this form to your paper return. Use this form only if you are an employee and your employer requires you to pay expenses to earn your. InstructionsUpdated: 4/PurposeTo provide a method for households to report self-employment income and expenses, if accurate tax or business records are. To enter unreimbursed employee expenses in your TaxAct return, go to our Form - Entering Unreimbursed Employee Expenses in Program FAQ. If you have a disability and claimed impairment-related work expenses on federal Form , complete Schedule M1UE and enter the amount from line 10 of this. Form is not needed and does not generate. If mileage is used on Form , it already includes a depreciation component. If actual expenses are more. Claiming tax deductible employment expenses; Allowable expenses; Flat rate deductions; Subscriptions; Course and examination fees; If your employer pays. Do you have unreimbursed expenses to include on your tax return? Learn how tax reform has changed the rules for unreimbursed employee expenses. The Canada Revenue Agency (CRA) has published revised guidance on the process for claiming home office expenses for the taxation year just in time for tax. Obtain T Declaration of conditions of employment · Complete the T and TWS · Related expenses to a T4 slip · Claim a GST/HST rebate · Select options for.

I hereby state that I am the person named above and have incurred employee business expenses as indicated on this form for the tax year shown above. I also. employment income and employment expenses to the. Department of Human If you do complete this form, your DHS office will be better able to determine. Obtain T Declaration of conditions of employment · Complete the T and TWS · Related expenses to a T4 slip · Claim a GST/HST rebate · Select options for. You should enter your employment expenses claim under the “1. Employment Income and Expenses” section in your Income Tax Return and select “Add New” > ”. Answer the questions about your occupation and follow the onscreen instructions to enter your employee expenses. You must sign in to vote. ON THE BACK SIDE OF THIS FORM. I certify that I have receipts or other forms of verification on file for all income and expenses reported on this form. I. Before you fill in this form, read the guidance in P87 Notes. If you are an employee use this form to tell us about employment expenses you have had to pay. If you are self-employed, see Guide T, Business and. Professional Income, for more information. Forms included in this guide. Form T, Statement of. Instructions for Form Employee Business Expenses. Employee Business Expenses. Instructions for Form Employee Business Expenses. This form is to record income and expenses for self-employment income. It is to be used only when other business or tax records are unavailable. Complete this form if you have home office expenses related to working at home in due to COVID See the Personal Tax Checklist for examples. Include Form T with your return. Form TL2, Claim for Meals and Lodging Expenses. Form TL2 is used by transport employees, such as employees of airline. If you're an employee and your employer requires you to pay for certain expenses as a condition of your employment, you can use the T Statement of. And you can claim those expenses using the tax form T You can easily get that form from the CRA's official website. The various sections. The first option is to file a single copy of Form T, in which you report the total employment expenses. Please note that you can select more than one type of. Any salaried employee or employee earning commissions who wishes to claim a deduction for employment expenses must have this form completed by their employer. This form is for reporting your business income and loss when operating as a sole proprietor. In addition, you must also file Form SE if you are self-. Include Form T with your return. Form TL2, Claim for Meals and Lodging Expenses. Form TL2 is used by transport employees, such as employees of airline. Go to IRS Form , IRS Publication , and IRS Publication (business use of your home) for more information about these and other business expenses that. View the chart below, whether you qualify for Employee Business Expense deductions via Form Keep in mind, if any of these expenses occur during your.

Mortgage To Buy And Renovate

For purchase transactions, total loan amount can be up to 75% of either the purchase price plus renovation costs or the “as-completed” appraised value. Find a purchase and renovate loan · Taking a single loan to cover renovation as well as purchase or refinancing, helping to simplify your debt payments · Low. An FHA (k) standard loan lets you borrow up to % of the home's after-renovation value, and you can use it to make structural repairs. Understanding mortgages and the home buying process can help make it less stressful, and so can partnering with a mortgage lender you can trust. At FBC Mortgage. The SONYMA RemodelNY program provides mortgage financing options that let you purchase a property and pay for repairs to turn that almost-perfect house into. Fannie Mae HomeStyle Renovation Mortgage. Government-sponsored entity Fannie Mae backs a mortgage product that is both a traditional mortgage and home. Renovation Loans are based on a home's estimated value after renovations are complete, allowing you to borrow more than a traditional home equity loan. Like the FHA (k) loan, the Fannie Mae Homestyle Renovation Loan can cover the costs of repairs and renovations as well as the purchase or refinancing costs. A renovation mortgage is similar to other mortgage options, except that you finance both the purchase price of a home, plus the cost of future repairs and/or. For purchase transactions, total loan amount can be up to 75% of either the purchase price plus renovation costs or the “as-completed” appraised value. Find a purchase and renovate loan · Taking a single loan to cover renovation as well as purchase or refinancing, helping to simplify your debt payments · Low. An FHA (k) standard loan lets you borrow up to % of the home's after-renovation value, and you can use it to make structural repairs. Understanding mortgages and the home buying process can help make it less stressful, and so can partnering with a mortgage lender you can trust. At FBC Mortgage. The SONYMA RemodelNY program provides mortgage financing options that let you purchase a property and pay for repairs to turn that almost-perfect house into. Fannie Mae HomeStyle Renovation Mortgage. Government-sponsored entity Fannie Mae backs a mortgage product that is both a traditional mortgage and home. Renovation Loans are based on a home's estimated value after renovations are complete, allowing you to borrow more than a traditional home equity loan. Like the FHA (k) loan, the Fannie Mae Homestyle Renovation Loan can cover the costs of repairs and renovations as well as the purchase or refinancing costs. A renovation mortgage is similar to other mortgage options, except that you finance both the purchase price of a home, plus the cost of future repairs and/or.

Renovation loans allow you to buy a home and pay for repairs and upgrades with a single mortgage · How much you can borrow for renovations depends on the type of. A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. One significant advantage of a renovation mortgage loan is that it allows homeowners to finance both the purchase or refinancing and the renovation costs in a. Rural non-owner-occupied duplexes, triplexes and fourplexes are eligible under the purchase renovation or refinance renovation option only. Loan to value (LTV). If you're looking to finance a fixer upper, one option is to consider a renovation loan such as the FHA (k) or Fannie Mae HomeStyle loan. The HomeStyle Renovation mortgage provides a simple and flexible way for borrowers to renovate What is the process to get access to Loan Quality Connect? If. This mortgage allows an investor to borrow the money to purchase a property that's in need of renovations and also to borrow money to do the renovations. House renovation mortgages are different to a normal mortgage. The main difference is that you'll borrow both the money for the property and the cash to perform. A USDA renovation loan allows you to finance % of the purchase and % of your renovation costs, plus repairs up to the “as-improved” market value. That. With Renovation Mortgages, borrowers can get access to permanent financing options they need to repair, restore, rehabilitate or renovate their existing site-. In a way, a Renovation Mortgage is like combining a home mortgage with a construction loan. You'll be able to purchase the home and borrow additional funds to. You can finance up to six months of mortgage payments into the home loan. For larger projects where it's not possible or preferable to live in the home during. Purchase a property and include the cost of repairs and improvements in the loan · Buy a home that is listed at a lower price due to the older existing condition. A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. Renovation loans allow you to buy a home and pay for repairs and upgrades with a single mortgage · How much you can borrow for renovations depends on the type of. Renovation loans can be received within 72 hours of applying, if not less. The application process is quick and simple. You need to carry the. The Purchase & Renovate Mortgage keeps things simple by providing one loan to finance the purchase and renovation of your new home. Combine a mortgage to refinance or purchase a home with financing to fix it up, too. Our HomeStyle Renovation loan gives you a single loan for both buying and. A Conventional Renovation loan lets you purchase a home and factor in the costs of repairs and remodeling. It's pretty simple: both your home loan and your. Advisors Mortgage Group offers a renovation loan program called FIX-IT MORTGAGE, which allows you to bundle the costs of your home renovation into your mortgage.

Best Home Service Warranty Company

:max_bytes(150000):strip_icc()/Select_home_Warrenty-ffd3b3bdee1040529af3f5da45134a5d.jpg)

Best Overall: Home Warranty Inc Home Warranty Inc. With an extra two months of coverage (14 months versus the usual 12 months) for an already competitive. Choice Home Warranty is the preferred choice with many real estate agents and companies, due to our excellent service and professionalism. An Old Republic home warranty plan safeguards your budget from expensive repairs and helps keep your home systems and appliances operating efficiently. A First American home warranty is a service contract that protects a home's systems and appliances from unexpected repair or replacement costs due to a break. Liberty Home Guard is our No. 1 pick because it has the best customer service ratings. Home Buyers Warranty is our second choice due to its affordable. Liberty Home Guard · Choice Home Warranty · Select Home Warranty · American Home Shield · First American Home Warranty · Cinch Home Services · The Home Service Club. Best home warranty companies · Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American. We chose American Home Shield (AHS) as the best home warranty company in North Carolina because it provides generous heating and cooling system coverage limits. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Best Overall: Home Warranty Inc Home Warranty Inc. With an extra two months of coverage (14 months versus the usual 12 months) for an already competitive. Choice Home Warranty is the preferred choice with many real estate agents and companies, due to our excellent service and professionalism. An Old Republic home warranty plan safeguards your budget from expensive repairs and helps keep your home systems and appliances operating efficiently. A First American home warranty is a service contract that protects a home's systems and appliances from unexpected repair or replacement costs due to a break. Liberty Home Guard is our No. 1 pick because it has the best customer service ratings. Home Buyers Warranty is our second choice due to its affordable. Liberty Home Guard · Choice Home Warranty · Select Home Warranty · American Home Shield · First American Home Warranty · Cinch Home Services · The Home Service Club. Best home warranty companies · Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American. We chose American Home Shield (AHS) as the best home warranty company in North Carolina because it provides generous heating and cooling system coverage limits. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America.

American Home Shield · Liberty Home Guard · Home Buyers Warranty · Elite Home Warranty · Cinch Home Services. Compare the best North Carolina home. We are an American home warranty company dedicated to protecting your valuable home systems and items with some of the best home warranty plans around. If we. Liberty Home Guard has consistently outperformed our competitors in customer satisfaction and the breadth of possible coverage. Everyday homeowners and consumer. fixHomz is the best home warranty company because we understand that homeowners are looking for more than simple appliance repair and home system coverage. Buy. The best home warranty providers in the US of include American Home Shield, Liberty Home Guard, Select Home Warranty and AFC Home Club. We Recommend HSP. We feel is the Best Home Warranty Company that we have worked with and they've gone above and beyond helping our clients getting things fixed. A home warranty acts as a contract to help you cover common repair costs at a discount. Home warranties cover appliances and HVAC systems, among other machines. The best home warranty for your budget When your home's systems and appliances break down, you'll want the best home warranty company on the case. America's. Popular Home Warranty Companies · American Home Shield (AHS) · Liberty Home Guard · ServicePlus Home Warranty · Choice Home Warranty · Elite Home Warranty · America's. Homeowners trust · Day Money Back Guarantee · ekaterina-khuraskina.ru · Best Company · Google Reviews. We offer the best service in the industry at the lowest cost. Choice is the best home warranty company for thousands of happy policy holders because we listen. We also like American Home Shield (AHS) for its comprehensive protection of essential home systems and appliances. In our survey of 1, homeowners, we found. Liberty Home Guard is an excellent service provider for homeowners who want a little bit more from their home warranty coverage. Its extensive list of add-on. Realtors Free Home Warranty · Realtors Free Home Warranty · Madison Flat Fee Homes · National Home Protection · AirOn Inc. · Southwest Services Inc · Reliable. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. The advantages offered by Liberty Home Guard include: · A national network with experienced and qualified service technicians · Courteous, experienced, and. American Home Shield is one of the most trusted home warranty companies in Arizona, with more than 2 million members and over 50 years in the business. A home warranty is a yearly service contract which covers the repair and replacement of important household appliances and home system components that. If you need a home warranty plan with roof coverage, the best home warranty companies to choose from are Liberty Home Guard and American Home Shield. Liberty. Super Home Warranty offers subscription plans that cover repair and replacement of home appliances and systems, and provides maintenance services for a flat.

Which Tax Software Is Better

ProConnect is the cloud-based tax software for accountants. Lacerte and ProSeries are desktop software options, and they offer a Hosting option for firms that. The best tax software for tax preparers is right here at Keystone Tax Solutions! We believe in setting our clients up for success. File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. Here are 9 of the best tax software and accounting solutions for rental property, according to Landlord Gurus, Investopedia, and The College Investor. However, for expatriates who earn regular employment income or are self-employed, it can be easy to file your taxes while living abroad using tax software. We. For comparison purposes, here is a list of the eight most popular online tax filing softwares ordered by price. Best Online Tax Software Providers Of September · TaxSlayer Premium – Best Tax Software for Customer Support · Cash App Taxes – Best Free Tax Software. There are features that the most basic tax software should have. These include multi-user access, e-filing, status reports, state modules, and vital schedules. Best Tax Software and Tax Preparation for September · Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax. ProConnect is the cloud-based tax software for accountants. Lacerte and ProSeries are desktop software options, and they offer a Hosting option for firms that. The best tax software for tax preparers is right here at Keystone Tax Solutions! We believe in setting our clients up for success. File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. Here are 9 of the best tax software and accounting solutions for rental property, according to Landlord Gurus, Investopedia, and The College Investor. However, for expatriates who earn regular employment income or are self-employed, it can be easy to file your taxes while living abroad using tax software. We. For comparison purposes, here is a list of the eight most popular online tax filing softwares ordered by price. Best Online Tax Software Providers Of September · TaxSlayer Premium – Best Tax Software for Customer Support · Cash App Taxes – Best Free Tax Software. There are features that the most basic tax software should have. These include multi-user access, e-filing, status reports, state modules, and vital schedules. Best Tax Software and Tax Preparation for September · Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax.

TurboTax is best for those who need more help — and are willing to pay a premium — while TaxSlayer is great for those who are familiar with taxes. Personal. The three best online tax programs with paid plans are undoubtedly TurboTax, H&R Block and TaxAct. Here's a quick look at how they stack up. Extremely easy, convenient and straightforward for nonresidents. I have used multiple tax softwares but Sprintax has been the best and never disappointed. TaxWise is the most professional tax software on the market. I have been using TaxWise since All others seem to want to match the DIY software options. UFile is a 5 stars Canadian Tax Software. Over a million Canadians put their trust in UFile products every year. File smart with UFile's 20 years of experience. The most obvious difference between TurboTax and H&R Block is price. Both offer four federal and state versions that support similar tax topics. H&R Block costs. Surprises aren't always good. With H&R Block, you'll know the price before you start your taxes. You can count on it. Compare online vs desktop tax preparation software to determine which is best for your tax business. Both software programs offer unique features. For comparison purposes, here is a list of the eight most popular online tax filing softwares ordered by price. H&R Block is a well-known name in the tax preparation industry. Several reviews named it the top tax software of for its overall performance, ease of use. Products In Tax Software Category · Avalara Platform · Avalara Platform · ProConnect Tax · ProConnect Tax · TaxAct Business Returns · TaxAct Business Returns. MilTax is a suite of free tax services for the military from the Defense Department, including easy-to-use tax preparation and e-filing software. UltraTax CS, the professional tax software from Thomson Reuters, will streamline and automate your entire tax prep workflow. Request your free demo today! TaxWise® provides tax preparers with the industry's leading professional tax preparation software that helps you maximize productivity, revenue. The most popular tax software programs include TurboTax, H&R Block, Cash App Taxes, and TaxSlayer. For over 10 years, UltimateTax has been a leader in professional tax software. Not all tax software is made equally. With UltimateTax, you can expect a stable. TurboTax is the biggest name in the tax software space, and for good reasons. Impeccable user experience, on-demand tax advice, and guided tax filing experience. This guide presents a list of the best tax software on the market. The key features of each platform are provided, as well as pricing information. Some people have used online tax preparation software for years. When would be the best time to consider hiring an accountant? What are a few items people tend.

Increasing Best Buy Credit Limit

If you're approved for an increased credit limit, make sure you don't misuse the increased buying power. Continue to make payments on time and in full. Don't. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best out of your rewards and offers. Now you. You have to call to bank's credit card department to request to increase your credit card limit. They will evaluate your eligibility first and. Now, they need to get your permission first. In the past, I got a letter offering to raise my limit by more than double. While I was temporarily tempted to. Increase your credit limits very quickly. without actually opening up new cards. Call the back of the card. and lot of times you can do it right over the. Increases · You've used your existing credit wisely · You consistently pay on time · Your overall credit score improves · You've reported an increase in income · You. How to Request a Best Buy Credit Limit Increase From Citibank on Your Own · 1. Log in to your credit card account. · 2. Select 'Card Services' and click 'Credit. It's also possible to ask for a credit limit increase, although there doesn't seem to be much success unless you wait until you've had the card for at least 9. In the Capital One customer portal, for instance, there's a “Request Credit Line Increase” option — the prompt asks about your current income, the amount of. If you're approved for an increased credit limit, make sure you don't misuse the increased buying power. Continue to make payments on time and in full. Don't. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best out of your rewards and offers. Now you. You have to call to bank's credit card department to request to increase your credit card limit. They will evaluate your eligibility first and. Now, they need to get your permission first. In the past, I got a letter offering to raise my limit by more than double. While I was temporarily tempted to. Increase your credit limits very quickly. without actually opening up new cards. Call the back of the card. and lot of times you can do it right over the. Increases · You've used your existing credit wisely · You consistently pay on time · Your overall credit score improves · You've reported an increase in income · You. How to Request a Best Buy Credit Limit Increase From Citibank on Your Own · 1. Log in to your credit card account. · 2. Select 'Card Services' and click 'Credit. It's also possible to ask for a credit limit increase, although there doesn't seem to be much success unless you wait until you've had the card for at least 9. In the Capital One customer portal, for instance, there's a “Request Credit Line Increase” option — the prompt asks about your current income, the amount of.

There is no sign-up bonus for the My Best Buy Visa Card. Card credit limit increases (limit changes are subject to credit underwriting and approval). However, issuers generally say it's best to wait about six months between requests, unless you've had a significant increase in salary in the meantime. The. Dell Pay allows you to pay over time with special financing B. Enjoy the flexibility to choose payment amounts which work best for you. With the Leap program, earn a credit line increase in 6 months by making qualifying on-time payments. Pay in full or carry a balance — pick your best payment. Learn about deferred financing with Best Buy, including how it works, payment requirements, account information, helpful resources and FAQs. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. Call your card issuer · Make a request online · Check if your issuer offers automatic limit increases · Increase your security deposit for secured credit limits. To request a credit limit increase · Log on to the mobile app. · Choose the relevant credit card from the account summary screen. · Select 'Manage card' at the top. You can request a credit line increase either online or over the phone. To request online, log into your account and select “Increase Your Credit Limit” under. How can I check my Best Buy Business Advantage card status or open a line of credit? Log in to your Best Buy Business Advantage account. Go to the menu on the. To request a credit limit increase, call your card issuer's customer service number (generally on the back of your card) or apply online. You will usually need. Make a request online. · You make on-time payments · Whether you recently had changes to your income · When you request a credit limit increase, this may result in. How to ask for a credit limit increase: Make an online request, call your credit card company, or open a new credit card with a higher limit. Increase your credit limits very quickly. without actually opening up new cards. Call the back of the card. and lot of times you can do it right over the. If you apply and are approved for a new My Best Buy® Credit Card, your first day of purchases on the Credit Card using Standard Credit within the first 14 days. Use the My Best Buy ® Credit Card and earn rewards or tap into flexible financing. Consider a new credit card. If you have a history of good – or great –credit, a new credit card with a higher credit limit may be a possible option to consider. Contact your Bank and request for a limit increase if your financial situation has improved. Keep your Credit Card balance below your limit; ideally, aim for. It's generally best to apply for a credit limit increase when: Your credit scores have gone up. If you've recently paid off a big loan or a negative credit. One way to access more credit is to request a credit limit increase. As part of the approval process, your issuer will review your credit history and consider.

Banks That Give You Direct Deposit Early

If you're a Huntington checking customer with direct deposit, you could get your paycheck up to two days early. Learn more about Early Pay today. Bank Accounts with Early Direct Deposits · 1. SoFi Checking and Savings · 2. Axos Bank Essential Checking · 3. Chime® Checking Account · 4. Ally Spending Account · 5. Chime · Wells Fargo · Discover · Fifth Third Bank · Navy Federal Credit Union · USAA · Capital One · Chase. Many money transfer apps also offer early. If you already have direct deposit established, no extra signup is necessary! Your direct deposit may automatically post early if it is eligible for Early Pay. As a personal checking or savings account customer, you could get paid up to two days early, just set up direct deposit and enjoy this automatic perk. Stop waiting for your money and get paid early with direct deposit when you open a bank account with early direct deposit from Varo Bank. Get access to qualifying payroll funds from participating employers or federal and state government payments up to two days early with Early Pay. The bank I mainly use is Affinity Federal Credit Union, largely because their customer service is fantastic. They do early direct deposit too. We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy. If you're a Huntington checking customer with direct deposit, you could get your paycheck up to two days early. Learn more about Early Pay today. Bank Accounts with Early Direct Deposits · 1. SoFi Checking and Savings · 2. Axos Bank Essential Checking · 3. Chime® Checking Account · 4. Ally Spending Account · 5. Chime · Wells Fargo · Discover · Fifth Third Bank · Navy Federal Credit Union · USAA · Capital One · Chase. Many money transfer apps also offer early. If you already have direct deposit established, no extra signup is necessary! Your direct deposit may automatically post early if it is eligible for Early Pay. As a personal checking or savings account customer, you could get paid up to two days early, just set up direct deposit and enjoy this automatic perk. Stop waiting for your money and get paid early with direct deposit when you open a bank account with early direct deposit from Varo Bank. Get access to qualifying payroll funds from participating employers or federal and state government payments up to two days early with Early Pay. The bank I mainly use is Affinity Federal Credit Union, largely because their customer service is fantastic. They do early direct deposit too. We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy.

This service can potentially make direct deposited funds available in your account up to two business days earlier than usual. Banks that offer early direct. Pay day can come a lot sooner with Early Pay. When you have direct deposit set up, you can get your funds faster. · Another great perk of CUTX membership · Get up. Unlock financial freedom with Get Paid Early at OneUnited Bank. Access your funds sooner via direct deposit and take control of your finances. Early Pay gives you access to eligible direct deposits – including paychecks, retirement, and social security – up to two business days sooner. Receive your direct deposit up to 2 days earlier with TD Early Pay. Early Pay is available on all personal checking and savings accounts at no extra cost. Chime · Wells Fargo · Discover · Fifth Third Bank · Navy Federal Credit Union · USAA · Capital One · Chase. Many money transfer apps also offer early. WSFS Bank now has Early Pay, which allows Customers to receive eligible direct deposits from their employers up to two days early. If you have a KeyBank account with direct deposit, you could receive your pay up to two days early automatically and at no cost. Learn more about KeyBank. Providing the same safety and security of traditional “on time” direct deposit, early direct deposit services release your paycheck into your account as soon as. When you set up direct deposit with any of our checking accounts, you could receive your paycheck up to two days early! You can get paid faster, which helps. Early Pay grants access to your direct deposit up to two days prior to the scheduled payment date. Chime is one such company that provides access to a wide range of banking services, including Get Paid Early. When you sign up for a Chime Checking Account and. Get paid up to 2 days early when you have a Citizens personal checking, savings or Money Market account set up with direct deposit! Why Wait for Payday? Equity Bank is proud to unveil EarlyPay! Now, customers can receive direct deposits hours earlier in their primary checking. Why are financial institutions willing to offer early direct deposit? ; Early Access Timing, Quorum will make direct deposits available days early, depending. The only thing better than payday is early payday! With Associated Bank's Early Pay you can get your money up to two days early! With direct deposit, you got it. Early Pay gives you access to your direct deposit from an employer or government agency up to a full day early with Direct Deposit. Get paid before payday with BankFive's Early Deposit. ; Fast. Access your direct deposits1 up to two days early. ; Easy. Designate a BankFive account for your. If you are a Citizens Personal Checking, Savings or Money Market account customer that has set up a direct deposit with a payor, you may be able to get that. Early Pay is available for personal checking or savings account holders in good standing who set up direct deposits for payroll, military pay, tax refunds.